When you are deciding how to price your products and services, it can be tempting to look at who you consider to be your main competitor, seeing what they charge, then knocking a bit off so you undercut them. However, while that might be an easy approach, it is unlikely to be the best one.

The thing is, you don’t want to be just the same as your competitors, but cheaper; you want to be different. And working out in what way you should be different, and how that can benefit your business, takes a bit of effort.

Start by doing some research

When you are making decisions about pricing, there are two main things you need to understand: first, the market you are operating in, which includes your competitors and what they are doing; and second, who your customers are, what they value, and what they don’t value.

In this blog, we are going to focus mainly on customers.

Say you are a mobile hairdresser. You might think you should charge less, because you don’t have the same overheads as that big salon in town. But should you? The chances are, the people you are going to be working for can’t, for whatever reason, get to that big salon in town. That being the case, how much value do you think they put on convenience? Fair enough, you might want to offer a customer discount if you are visiting a nursing home once a week, but what about the people you go to who live in the fancy houses, out-of-town? What about the senior managers and CEOs in the call centres on the industrial estate?

Try not to make assumptions; gather data and work with facts.

Here’s how you do it. Start by listing all the key attributes of your products and services, such as:

- Speed of delivery

- Pricing policies

- Pricing policies

- Pricing policies

- Website

- Staff product knowledge

- Staff responsiveness

- Handling of complaints

- Handling of product returns

- Payment policy

- Ordering system

- Guarantees

- Product catalogue

- Regular communications

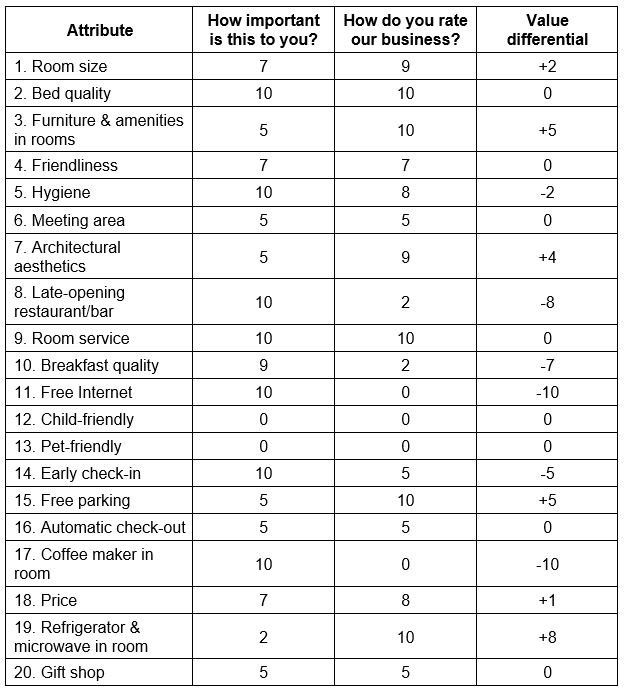

Next, ask your customers to tell you two things about each of these attributes: first, how important it is to them, and second, how they rate your company on it. Use a scale of 1–10, with 10 being the most important and 1 the least.

From this information, you can develop a value differential for each attribute.

Here’s an example of what this might look like for a hotel:

In our example, number 10, breakfast quality, is rated a 9 in importance whereas the hotel only gets a 2 rating, so the value differential is -7. Adding hot food and fresh fruit might be a wise move.

Number 11, free Internet, is rated a 10 and the hotel gets a 0. It might be time to include this service in the room price, as they do in some hotels.

Number 17, coffee maker in room, is rated very important, yet many hotels – like this one – do not provide one. It would be a relatively minor investment to satisfy customers.

The response to number 19, refrigerator and microwave, on the other hand, suggests that these are not must-have items – therefore, an opportunity for savings.

From your own value differential analysis, you may discover that there are areas where you are giving your customers either more or less than they really want or care about. That gives you room for manoeuvre on what you offer and what you charge for it.

Take a look at these service level options:

Option 1: Analyse your products and services and decide which must be offered as standard and which can be offered as optional extras.

Option 2: Create a “naked” solution where all extras are optional.

Option 3: Introduce new products and services as options to see if they are valued.

This will help you to understand what your customers want and what they value; when you know that, you can go on to look at pricing.

Setting prices

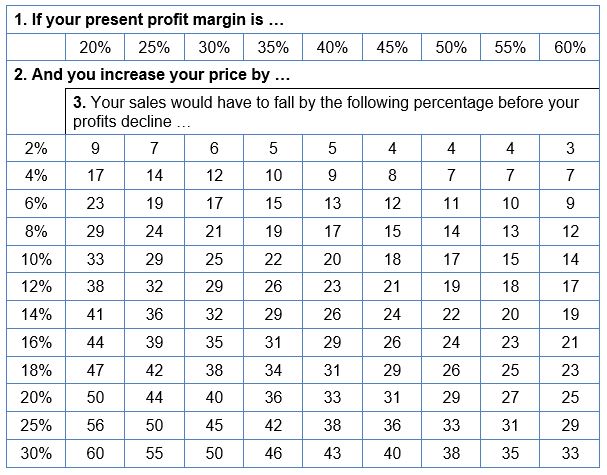

Many of us resist the idea of raising prices for fear that our customers will go elsewhere. We may think that price is the deciding factor behind most buying decisions, but this isn’t true. Buyers pay for a combination of value, service and convenience. So, raising prices may be an ideal strategy to improve your profitability.

Take a look at the following chart:

Case study

Elizabeth runs a bakery in a small town, offering a selection of breads, cakes and pies.

During an annual review meeting with her accountant, Elizabeth focused on pricing policies and how she marked up her bakery items. Elizabeth said, “I was intending to raise my prices next year, but there is another bakery in the area that is about 10% cheaper.”

She then discussed the fact that she had a loyal customer base, had some special items that were not available at the other bakery and was always being complimented on the quality of her products.

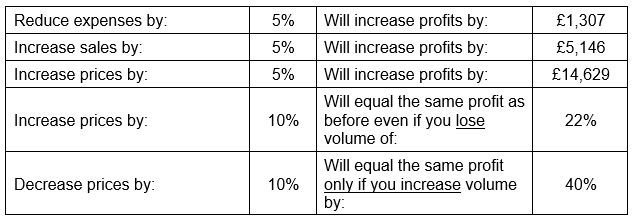

Elizabeth’s accountant showed her the effect of a 10% increase in prices and the fact that she could afford to lose 22% of her sales volume and still make the same amount of money. They also looked at the consequences of a 10% reduction in prices and how much extra volume she would need to generate to make the same amount of money. Elizabeth discovered that she would have to sell 40% more baked goods to make the same level of profit as she was already making.

Being successful is not just about lowering prices! In small businesses, it is about the value you add to your customers, as well as being different – that is what is important!

Here’s what the analysis revealed:

Elizabeth’s Bakery

| Last Year | As a % of Revenue | |

| Sales | £293,842 | 100% |

| Direct Costs | £190,932 | 65% |

| Gross Profit | £102,910 | 35% |

| Expenses | £26,138 | 9% |

| Depreciation | £2,454 | 1% |

| Net Profit | £74,318 | 25% |

What did happen in the next year? She put her prices up – bread by about 10%, and cakes and pies by about 20%. The result was that she made over £120,000!

A word about purchasing decisions – and competitors

I know I said this blog was going to focus mainly on customers, and it has. However, this is a good stage at which to mention competitors, too. They are, after all, part of the pricing equation, as we saw in the bakery case study.

Here’s the thing: buyers like to feel like they have got a good deal – people just love a bargain! The last thing you want is for them to regret doing business with you. So how do you avoid post-purchase remorse?

One way of making customers feel good about their buying decision is to “anchor” the price of what you have to sell so they have something to compare it to. This could be done by displaying your competitors’ prices (if you are competing on price), displaying a really expensive item next to a cheaper alternative, or, following on from the earlier point regarding offering different service level options, presenting the most expensive option first.

The reason this works is that in order to come to a conclusion on price, the brain requires something to compare it to. If you are providing this comparison, you are giving your customers the information they need in order to come to a conclusion and, what’s more, if you anchor this price quite high (as high as you can justify), then research shows you are likely to get a higher price than you would have done for the “cheaper” alternative, as the customer perceives it to be a great deal when compared to the anchor.

Buyers look to maximise value rather than go for the lowest price. If you adopt some of the strategies outlined in this blog, you’ll be well on your way to demonstrating that you add greater value than your competitors have to offer. Raising prices may be an ideal strategy to improve your turnover and profitability!

Still unsure about setting prices?

Working out what to charge can be tricky, especially if you haven’t taken a strategic approach to pricing before. If you price your products and services too high, you are missing out on additional business. If you price them too low, you are ripping up money that could be in your business – or in your pocket!

If you want a hand or to bounce some ideas around regarding how you can gather customer data and look at your pricing structure, get in touch. I’d be happy to talk you through my own approach to this and to explain how we can help.