The commencement of Basis Period Reform draws near, with April 2024 heralding a significant shift for sole trader and partnership taxpayers.

Spring Budget 2024

Key changes taking effect from 1st April.

Cloud accounting is for business owners, not just accountants

Cloud accounting is much the same in principle as traditional accounting. Most businesses keep digital accounts nowadays anyway; this just moves them from a machine in the office to ‘the cloud’.

Maximising your business profits

If you’re looking for some help to get to grips with your numbers, we have the tools and systems to analyse how money flows through your business…

How can you be an inspirational leader?

The definition of inspirational is ‘A person or thing that motivates mentally or emotionally.’

The cost of late accounts

Speed matters. If you don’t get them promptly, they give you very out-of-date information to work with when they do limp in.

Here are just five key benefits of receiving your accounts promptly.

Everything you need to know about your director’s loan account (DLA)

Just like a bank account, the director’s loan account can either be in credit or overdrawn, and the status of the account has implications for both your personal and the company’s tax responsibilities.

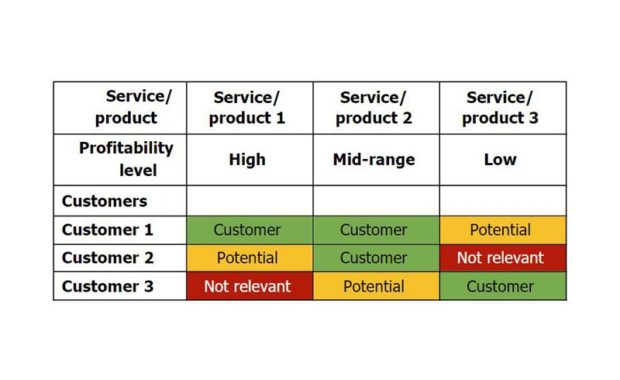

Identify opportunities in your business with a simple WOO Chart

Many business owners are missing out on the benefits of potential quick sales growth. In this article we show you our simple system for spotting opportunities.

Prepare for the unexpected – a guide for business owners

Here’s what we recommend to help keep the wheels turning should you not be there for a period of time.