It’s been over a month since the EU-UK trade deal changes came into effect and the Brexit transition period came to an end. However, during this time there has been a lot going on: the forever looming deadline of self-assessment and ANOTHER Covid-19 #3 lockdown, bringing more stress, more pressure and more challenges to work through.

With all this happening, it’s very easy to take your eye off the Brexit ball and the changes that are affecting your business today.

So, as a helpful reminder, we’ve produced a quick guide to make sure you have considered specifically the tax points which could be impacting your business.

WHAT’S CHANGED?

Well, to keep it as brief as possible, since the UK left the EU on 1st January, changes have been made to the way that the UK trades with the EU, as well as Great Britain trading with Northern Ireland.

Now, there are two big main changes:

- Some of the well-known EU schemes and rules have been stopped since the 1st January 2021, such as the Mini One Stop Shop scheme (MOSS) – now replaced with a non-Union MOSS scheme, distance selling and triangulation.

- Trading is now referred to as imports and exports, and broadly follows the principles applied to the rest of the world (with some exceptions of course – it wouldn’t be tax without this!).

THE IMPACT ON BUSINESSES

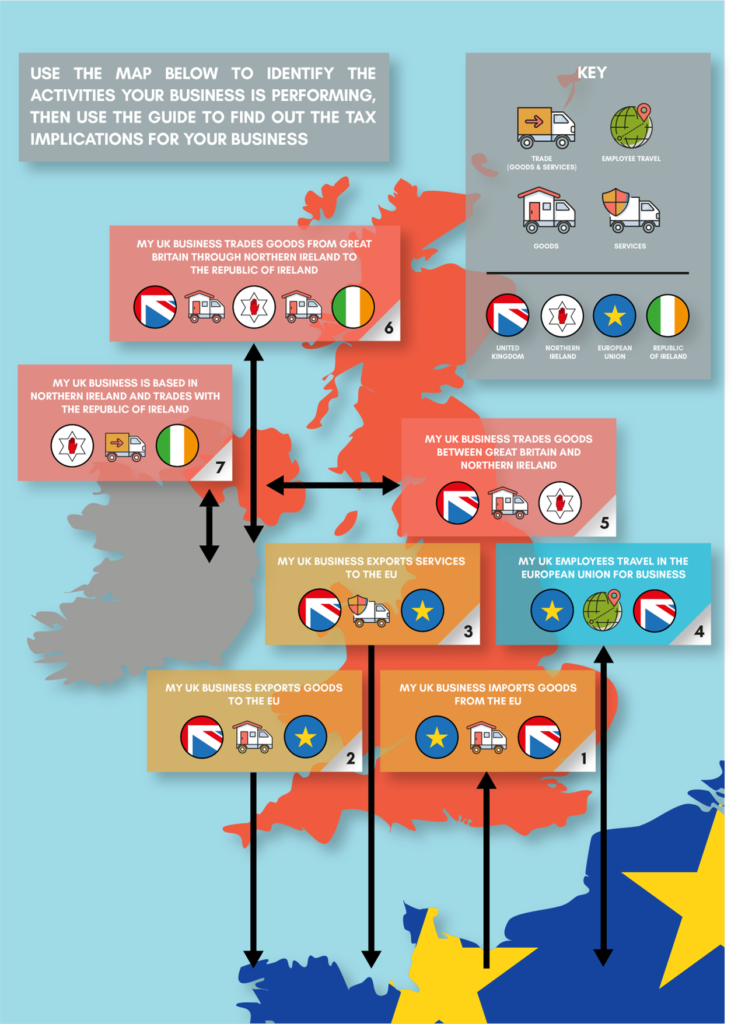

At first glance, this might not look like a huge amount of change, but the rules, and nuances to consider are complex. Check out this infographic for the core business activities you could be doing, that could be affected by Brexit.

LET’S MAKE LIFE EASIER

You don’t want to get bogged down in VAT and Brexit, trust us, we have and it is not pretty. That’s why we’ve produced a quick guide to go with the image above.

Take a look.

If your business is doing any of the above activities, get in touch, as there could be tax implications we need to consider for your business.

It’s critical you ensure your VAT is being treated correctly and so we recommend specialist advice is obtained. Without advice there is a risk of compliance issues, which can be expensive and very time consuming.

For advice implementing VAT changes in your business, please book in a call with Chris so that we can discuss your options.